The tools that make our jobs possible

When my co-worker Sami Springman and I joined Statsig, we both came from Snowflake- a mature sales organization with every bizdev tool you could dream of.

As the first sales people at Statsig, we’ve been building our biztech stack from zero. After some trial and error, we have a list of 4 tools we can’t live without.

Sales Navigator

LinkedIn has become such a staple channel of sales outreach that it’s sales add-on, Sales Navigator, is a must-have. I got our sales nav licenses within a few days of joining Statsig. For building lead lists and searching specific profiles, Sales Navigator is unmatched.

To be totally candid, without Sales Navigator, my job would be next-to-impossible.

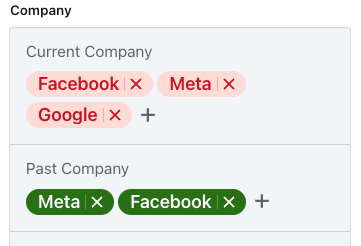

We’ve always used Sales Navigator to pull lists of employees at specific companies- but now we use Sales Nav for more than just that. Statsig replicates some of the infrastructure at Facebook, so the ex-Facebook community is a huge market for us.

Sales Nav has a ton of intuitive filters to find former Facebook (Meta?) employees- which for us is a gold mine. Some of our best customers were found through these filters.

Zoominfo

We initially didn’t splurge for ZoomInfo, and regretted it. ZoomInfo’s database of contact info is irreplaceable- especially for finding mobile numbers.

We get a lot of personal/gmail registrations through our site, and ZoomInfo’s reverse-search has been super helpful in tracking down prospects with obscure/ personal emails.

If you are going to find a personal email anywhere, it’s on ZoomInfo. ZI doesn’t have a 100% hit-rate, but their personal contact info is way more accurate than other similar tools.

On a practical note, ZoomInfo is idiot-proof (read: me-proof). ZI’s integration with CRMs (we’ve used with both Hubspot and Salesforce), and LinkedIn have never glitched, and it works so well that you hardly notice it’s there.

Most of the outbound business we source is either directly through LinkedIn, or from Zoominfo phone numbers/ emails.

Outreach

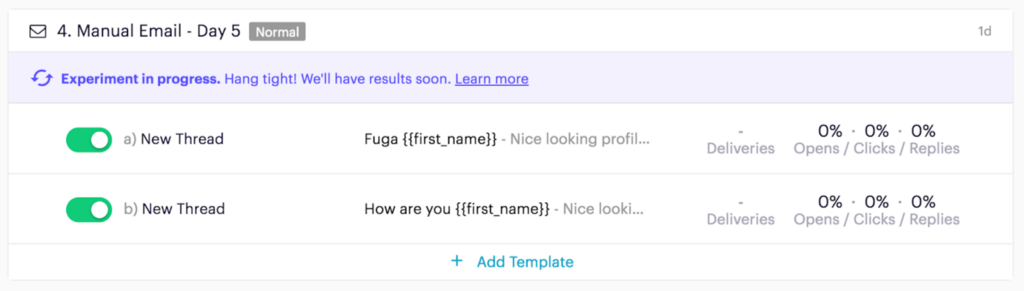

Outreach is my go-to tool for out-bounding at scale. Outreach is super intuitive, and on top of automating sequencing and calling, they’ve added some nice functionality around booking and team reporting.

Experimentation is at the core of Statsig, and we also love Outreach’s ability to A/B test email and sequence variants. In our experience, once you use Outreach, other “similar” tools lack features that become hefty parts of the outreach process. For SDRs focused on volume, Outreach is the way to go.

The only caveat for Outreach- the tool is less useful for account execs who aren’t making many cold calls + bulk emails.

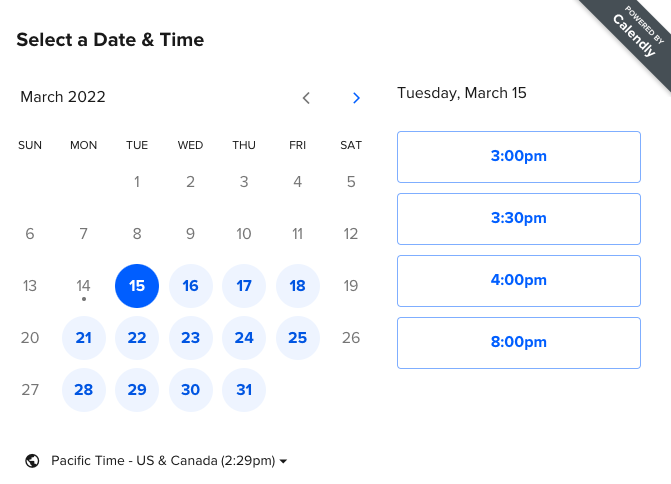

Calendly pro

We’ve been using Calendly for the last year and finally upgraded to pro (for a whopping $16/ month). We work with teams across Europe and Asia, and coordinating time zones gets confusing quickly. Calendly makes it super easy to find times that work for everyone.

Calendly’s free tier is amazing on its own- and the upgraded plan has been helpful for booking calls with several team members. No more digging through calendars to see when my sales engineer or manager is available. Automated day-of reminders have also lightened everyones’ load.

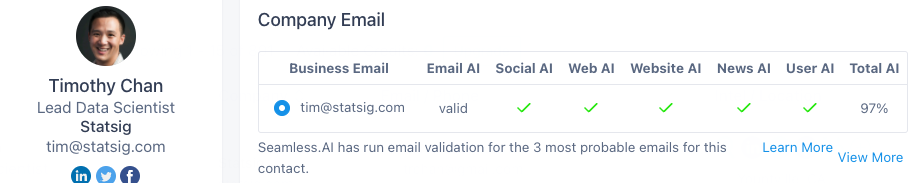

Seamless.ai

While ZoomInfo is a great database for contact info at established/ enterprise companies, Seamless.ai has been a nice add-on for small-to-medium accounts. Seamless isn’t a database- instead, the platform uses AI to predict emails.

For younger orgs without published contact info, Seamless has been very helpful.

Because Seamless isn’t a database, there aren’t many personal numbers or emails. My suggestion is pairing ZoomInfo and Seamless to get the most robust coverage for both enterprise and small business accounts.